Financial planning can be measured in a variety of different ways. Traditionally, research has leant towards measuring financial success in terms of how advisers could add value around an investment portfolio. However, in recent years, it has been recognised that financial planning can have an impact in a wide range of areas, from income planning, estate planning, tax planning and protection. Increasingly, clients have also placed importance on saving their own valuable time by handing over their financial planning to an adviser. Successful DIY investing requires extensive research and is ultimately time-consuming!

It is also important to recognise that successful financial planning is not just about investment strategy but also the delivering of the proposed investment and measuring its medium and long-term success.

Over the past few years, there have been three popular, independent studies estimating the economic benefits of financial advice – Morningstar Gamma, Vanguard Adviser Alpha and Envestnet Capital Sigma. All three studies have used slightly different measurements to evaluate the economic benefits of financial advice – from lower cost investment selection, portfolio re-balancing, to maximising tax efficiencies.

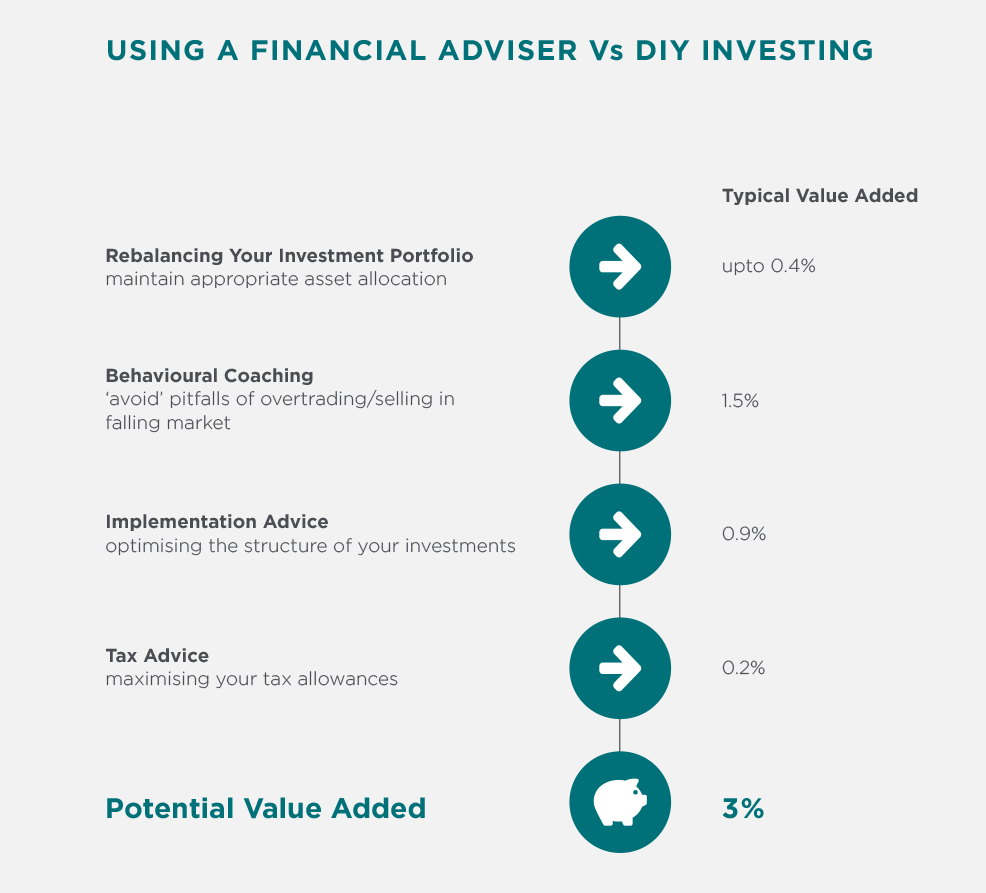

HOWEVER, THE FINDINGS SHOW THAT VANGUARD AND ENVESTNET CAPITAL SIGMA SHOWS AN OVERALL VALUE ADD-ON BENEFIT OF GREATER THAN 3% PER YEAR ON YOUR PORTFOLIO COMPARED TO NOT USING AN ADVISER.

The Morningstar Gamma study also shows a value add-on of 1.59% per year. Taking the Adviser Alpha study by Vanguard as an example, how is the value add-on figure of 3% calculated?

With the recent developments of cashflow modelling software, financial planning has empowered the adviser to project spending over a significant time period to identify shortfalls in retirement income well before retirement age and allow the adviser to put in place medium-long-term strategies to make up this shortfall. Sometimes, for many retirees, the benefits lie not in monetary terms but in an understanding of when they can retire and how much money can be safely spent in retirement ultimately giving them peace of mind.

Ultimately, for many of us, other demands in our lives prevent us from ensuring that we conduct our own financial planning. Using a financial adviser stops us from making financial mistakes or putting off immediate financial decisions that need to be made. Financial planning enforces a discipline that can change your existing behaviour towards your finances and help you identify your long-term financial strategy to reach your lifetime goals.

Article References

https://www.envestnet.com/sites/default/files/documents/ENV-WP-CS-0516-FullVersion.pdf

https://www.morningstar.com/content/dam/marketing/shared/research/foundational/677796-AlphaBetaGamma.pdf

http://www.vanguard.com/pdf/ISGAA.pdf